For people with vehicles to drive in Saudi Arabia, it is mandatory to have their vehicles ensured either comprehensive insurance or at least third party insurance as this is a legal requirement. With comprehensive insurance, in case of any accident, both first party and third party are covered while in case of third party insurance, your own car is not covered and only third party is covered.

In this post, I will share my experience of online car insurance in Saudi Arabia.

My car insurance was about to expire in a few days, so I was in search of some agents to get my car insurance renewed for another year. Previously I visited the office of an agent who did all the processing for me on his computer and provided me an insurance after sharing with me the price quotes for different insurance companies. I visited multiple agents as I observed price variations as some of them charge more fees while others charge less.

This time, through a friend, I came to know that I can buy insurance policy for my car online without visiting any agents outside. After hearing this from my friend, I really felt a sigh of relief as It is always time consuming as well as hectic to travel around the city and visit different agents and bargain with them to find the best quote. With traffic conditions in cities like Jeddah, it is no more than a blessing if you can get such services done online.

Cutting the story short, my friend told me that you can get your car insurance through Tameeni. Tameeni is a well-known and licensed “Online Insurance Marketplace”, and is owned by “Insurance House Co.”.

First thing that caught my attraction to this site was its User Interface as I found it user-friendly and bilingual with support for both Arabic and English. In order to avail their services, I first created an account on their site and with an OTP sent to my phone, I was able to register within a couple of minutes or so.

After logging in into my account, I land into a dashboard page where I have option to purchase a new insurance policy. In case if someone has already a policy purchased before, he will be able to see details of any existing policies as well.

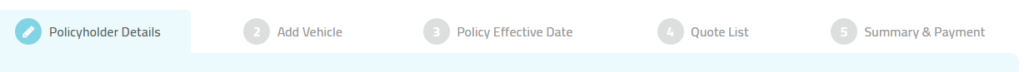

For purchasing a new policy, you can choose either TPL (third party) or comprehensive. You will add policy holder details and then in the subsequent steps you can add vehicle details, policy effective date & then system will fetch and list all the available quotes for you. You can explore details for each quotation and then choose the one that best suits you. Prices for insurance quotes vary depending on the insurance companies as coverage and services provided by different insurance companies differ.

For the insurance price, you will also observe that insurance companies by law provide a special discount known as NCD (No Claim Discount) if you haven’t made any claims with insurance companies previously.

After entering all details for my car and reviewing the quotes offered, I chose the one that best suited me in terms of price and coverage options. I observed a great deal of convenience here contrary to what I observed visiting an agent as here in online mode, everything was under my fingers and in my own time convenience I was able to explore and choose an insurance with price lesser than what I had to pay If it was done through an agent (as no agent fees or processing fees here).

After selecting the insurance for my car, I was moved to the payment page where I had to enter my IBAN (in case of any refunds) and I chose SADAD as my payment method out of different payment methods available. You can choose credit/debit card as well for payment of the insurance price.

After choosing SADAD, I got an SMS and email with details including biller id, bill reference etc. so I was able to login to my bank account and through bank’s online payment services, I was able to complete the payment very conveniently.

After payment, within a couple of minutes, my car insurance was completed and I got SMS from Tameeni, from the insurance company as well as from MOI-MOROR stating that insurance has been done successfully.

I was able to print insurance paper, payment receipt and insurance card as all these were available in PDF format in my Tameeni account dashboard.